Ponzi Scheme

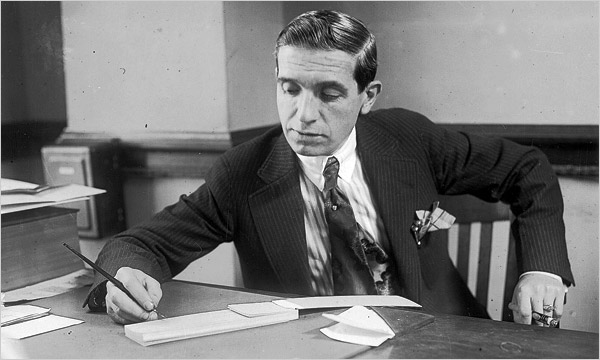

A Ponzi scheme is a type of financial fraud that operates on the "rob Peter to pay Paul" principle. Named after Charles Ponzi, who perpetrated such a scheme in the early 20th century, the scheme promises high returns on investments with little or no risk involved. Here's how it generally works:

Basic Structure

Initial Pitch: The fraudster promises investors high returns, often much greater than what is available through traditional investment methods. The scheme may be dressed up in complicated jargon, or associated with exclusive opportunities, to make it seem more legitimate.

Investor Recruitment: The initial investors buy into the scheme, often encouraged by the promises of high returns without significant risk.

Payment of Returns: Unlike legitimate investments, which generate returns through profits or interest, a Ponzi scheme pays returns to earlier investors using the new contributions of more recent investors. Initially, as more new investors join, there may be enough incoming funds to pay the "returns" to earlier investors, creating the illusion that the scheme is profitable.

Growing the Scheme: To keep the scheme going, the fraudster must continually recruit new investors to provide the funds needed to pay returns to existing ones. This is why Ponzi schemes often rely heavily on marketing or community trust.

More Recruitment: Satisfied with receiving their returns (unaware that it’s coming from new investors' capital), initial investors may reinvest in the scheme and may also encourage others to join, thus providing more funds to keep the scheme operational.

Crumbling Structure: Eventually, the scheme collapses because the returns owed to earlier investors often exceed the money being brought in by new investors. Another reason for collapse is that the organizers cannot recruit enough new participants to keep it going.

Exposure and Legal Consequences: Once the scheme stops generating enough new investment to pay existing investors, it collapses, and most investors lose their money. The organizers, if caught, face heavy legal penalties, including imprisonment.

Red Flags

- Promises of high returns with little or no risk.

- Overly consistent returns.

- Unregistered investments and unlicensed sellers.

- Secretive or complex strategies that are hard to understand.

- Issues with receiving payments or cashing out your investments.

Ponzi schemes can be quite sophisticated and may operate undetected for years, but they all eventually collapse. The best way to protect yourself is to be skeptical of investment opportunities that offer high returns with little or no risk, and to consult with financial professionals you trust before making any investments.